inherited annuity tax calculator

The first is a partial sale. Youll pay tax on everything above the cost that the original annuity owner paid.

Annuity Taxation How Various Annuities Are Taxed

If you change your answer to no part of the distribution was not an RMD your problem should go away.

. Qualified Inherited Annuities All death benefits will be subject to taxes. Appeared first on SmartAsset Blog. According to the Internal Revenue Service spouses calculate the tax-free part of received annuity payments the same way the primary annuitant did.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. Inherited Annuity Tax People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. If they come from his employer then they are probably qualified plans subject to RMD if he was over the age of 70 12 when he passed away.

If youre married for example you may name your spouse as a beneficiary. Partial 1035 Exchange of Annuity. But the basic tax formula in that case would be something like this assuming no special deductions no other income and that your mother is single and over 65.

Often those inheriting an annuity choose a lump-sum payout. RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account value. Continue reading The post What Is the Tax Rate on an Inherited Annuity.

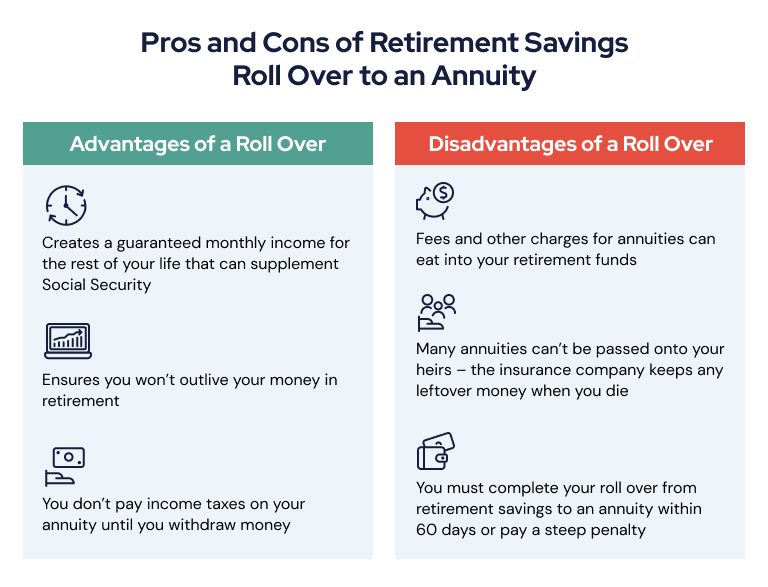

For an inherited annuity that is in an IRA you have 10 years to take the funds. 85 if the max of SS that is taxed if one is single and have more than 34000 in other income. This allows partners to enjoy the same tax-deferred benefits as the original annuity owner.

In that case the taxation is much simpler. If inherited assets have been transferred into an inherited. 1099-R amount 85 of SS benefits - standard deduction 12400 1300 if over 65.

Any beneficiary including spouses can choose to take a one-time lump sum payout. It is a general guide not personal advice and does not cover every nuance of the. The calculator works out whether your estate may be subject to inheritance tax if you were to die today.

Nonspousal Inherited Annuity If youre a non-spousal beneficiary you may have the option to transfer the death benefit amount into a new inherited annuity. The earnings are taxable over the life of the payments. If the annuity was an IRA annuity the SECURE Act that went into effect on January 1 2020 stipulates that if you inherit an IRA youll now generally have 10 years after the account holders death to withdraw all the money.

You can choose the 5-Year Rule that requires the person who has inherited the annuity to receive the full distribution of the total dollar amount within 5 years of the owners death. Or if you have adult children you might like. Unlike a 1035 Exchange which concerns the transfer of entire annuity contracts annuity owners have the opportunity to exchange a portion of their annuity contract for another annuity contract tax-free.

An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or beneficiaries. To account for payments occurring at the beginning of each period it requires a slight modification to the formula used to calculate the future value of an ordinary annuity and results in higher. The basis is divided pro-rata not income-out-first.

Because your wife chose to cash in the annuity a portion of what she received will be income. Here you would sell a period of the annuity disbursement or a portion of each payment. Qualified annuity distributions are fully taxable.

For instance if half the value of the annuity is. The result is leaving a tax-free death benefit for your beneficiaries. This process lets the insured spread the taxable income in the funds used to purchase the SPIA over a 57 or 10 year payment period.

Another choice is called a NonQualified Stretch. Nonqualified Inherited Annuities Only the interest earned will be subject to taxes. Lump-sum distributions withdrawals from non-qualified annuities are broken down into basis and earnings.

How taxes are paid on an inherited annuity will depend on the payout structure selected and the. If you opt to receive a lump-sum payment of all funds within the annuity you will be taxed for the full amount at one time in keeping with standard income tax regulations. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of calculating your tax.

The earnings come out and are taxed first and the basis comes out after the earnings are exhausted. Annuities can provide lifetime income for retirees and they can continue paying out after the purchaser passes away. If you inherit a non-qualified annuity the method by which you choose to withdraw the funds will determine how you are taxed.

So if you have an annuity that promises payments for the next 10 years you could sell five years of these payments. What can or cannot be done with an inherited IRA and how distributions from the account are made both depend on who the beneficiary is or beneficiaries are. When you inherit an annuity the tax rules are similar to everything described above.

If you dont youll face a 50 penalty on any money remaining in the account. If your father was older than 70 ½ you can use this web site to calculate the RMD. These hybrid plans also can fulfill RMDs for your IRA or 401 k as well.

If you were born before Jan. You actually have two options if you decide to part with the inherited annuity.

Qualified Vs Non Qualified Annuities Taxation And Distribution

Annuity Beneficiaries Inheriting An Annuity After Death

How To Roll Your Ira Or 401 K Into An Annuity

Own An Inherited Annuity Stretch Your Assets With A Low Cost Tax Efficient Option Kiplinger

How Are Annuities Taxed For Retirement The Annuity Expert

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Taxation How Are Annuities Taxed

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Qualified Vs Non Qualified Annuities Taxes Distribution

Inherited Annuity Tax Guide For Beneficiaries

Annuity Exclusion Ratio What It Is And How It Works

Inherited Annuity Tax Guide For Beneficiaries

Annuity Beneficiaries Inheriting An Annuity After Death

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

Annuity Taxation How Various Annuities Are Taxed

Annuity Contributions Tax Deductible Or Not 2022

What S The Difference Between Qualified And Non Qualified Annuities