how does zillow calculate property tax

A combination of high property tax rates and high home values in northeast New Jerseys Bergen County means that the median property tax bill is more than 10000 the highest the US. Then ask yourself if the amount of the increase justifies the work it will take to.

Zillow Reviews 723 Reviews Of Zillow Com Sitejabber

For example a property with an assessed.

. To calculate the property tax the authority will multiply the assessed value of the property by the mill rate and then divide by 1000. How does zillow calculate property taxglock fade percentage October 27 2022. Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property.

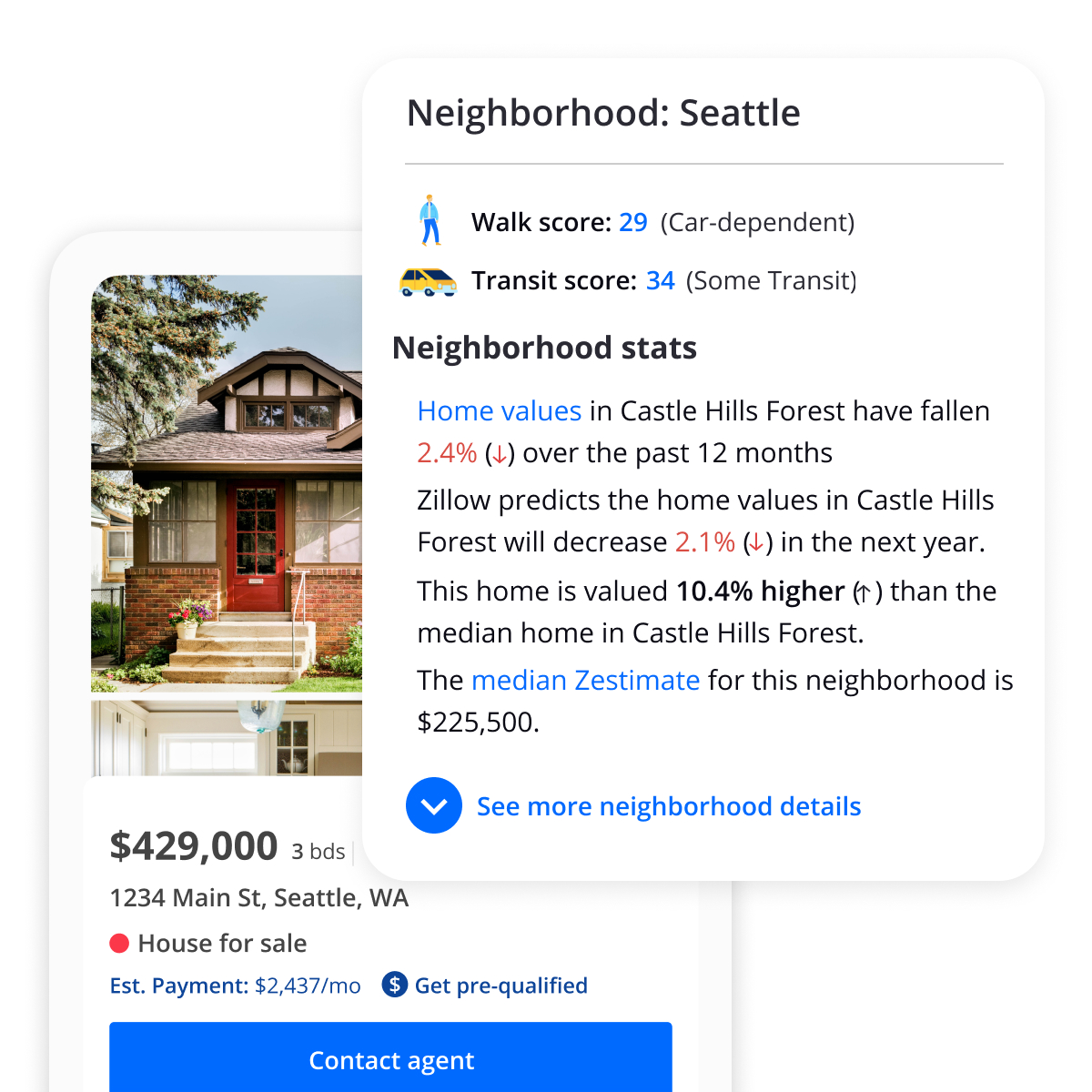

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Im starting to wonder if they are accurate. Zillow valued that home at 1230563 but it sold for 1495000 and for cash with no financing involved.

To calculate a Zestimate Zillow uses a. 189 of home value. Tax amount varies by county.

Then you multiply that amount by the number of rooms in the house. The property tax rate in most. To calculate a Zestimate Zillow uses a sophisticated neural network-based model that incorporates data from county and tax assessor records and direct feeds from hundreds.

Once you know the propertys value you simply multiply that by the tax rate. The Assessed Value of a real estate property is the value assigned to a property to determine applicable taxes. I found a house that is listed at 170k.

The market value of your home multiplied by. Calculate what your actual property tax bill will be with the higher value and any tax exemptions you qualify for. That Zestimate was more than 20 too low.

To calculate the property tax the authority will multiply the assessed value of the property by the mill rate and then divide by 1000. The market value of your property is assessed by using one or. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home.

Assessed valuation determines the values of a home for tax. To calculate the property tax the authority will multiply the assessed value of the property by the mill rate and then divide by 1000. It says the property taxes last year were 2480 on an assessed value of 68650.

Finally the fourth home was. That works out to a. Your areas property tax levy can be found on your local tax assessor or municipality website and its typically represented as a percentagelike 4.

Zillow Rent Estimate Calculator Zillow Rental Manager

How To Value Your House And Split Equity In Divorce

Real Estate S Latest Bid Zillow Wants To Buy Your House The New York Times

Putting Zillow Zestimates Accuracy To The Test Nerdwallet

Redfin Vs Zillow Which Home Value Estimator Should You Really Trust Home Bay

Zillow S Troubles Raise Questions About Zestimate Accuracy Money

Zillow Unveils New Feature For Millennial Home Buyers Money

An Estimated 123 000 Dreamers Own Homes And Pay 380m In Property Taxes Zillow Research

Zillow Vs Redfin Which Is Better For Homebuyers Gobankingrates

How To Create A Real Estate Website Like Zillow Trulia Greenice

Property Taxes Definition Zillow

How To Increase Your Home S Zillow Zestimate Toughnickel

Tiktok Video Accuses Zillow Of Manipulating The Housing Market Here S What S Really Going On Marketwatch

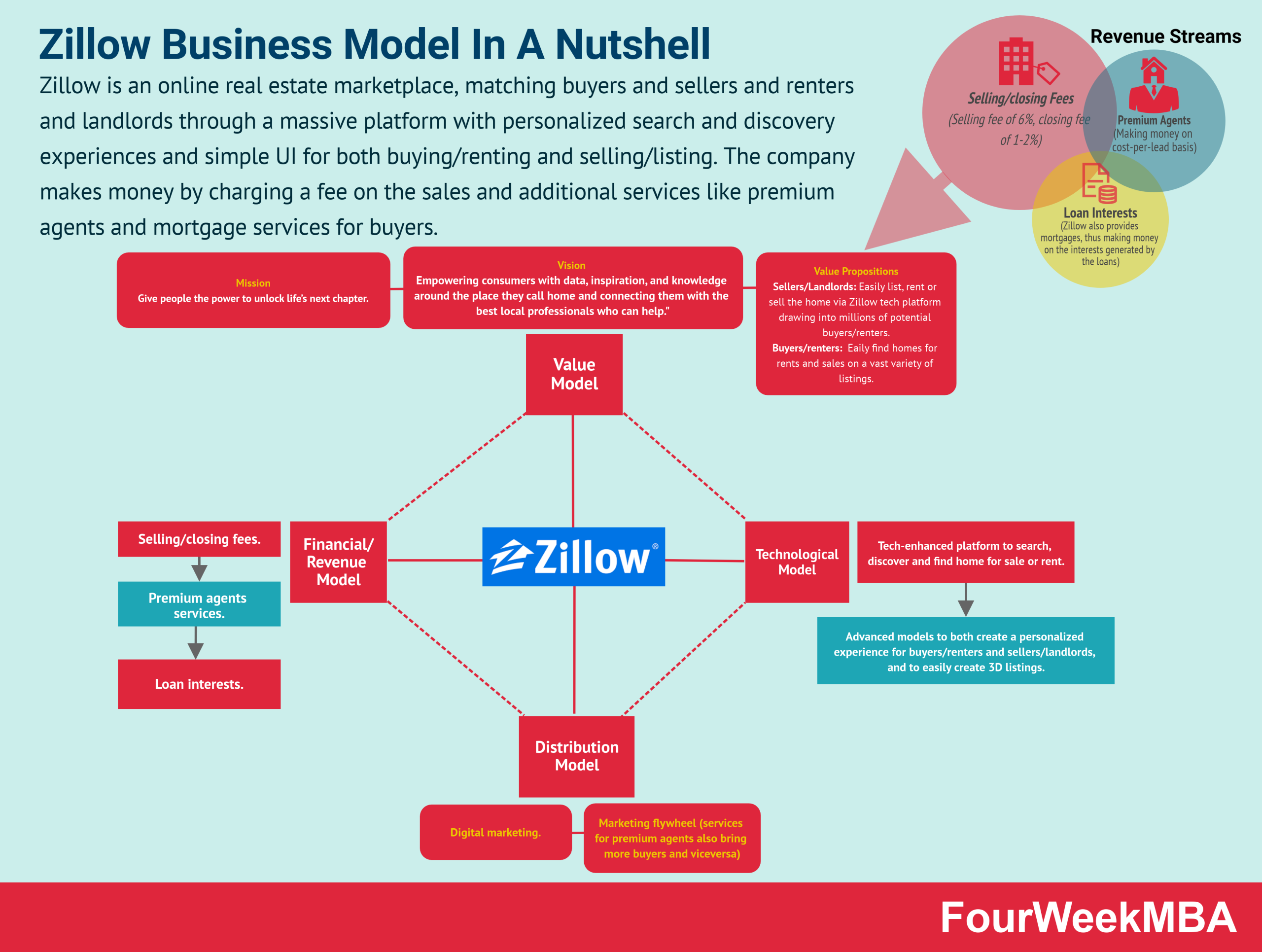

The Zillow Business Model How Does Zillow Make Money

How To Find A House On Zillow With Advanced Search Techniques Zillow

Are Zillow Zestimates Accurate Truth On Real Estate Estimates

Zillow Calls It Quits On Home Flipping Takes 304m Writedown Nasdaq Zg Seeking Alpha

Latest Zillow Scam Lists Multi Million Dollar Jacksonville Home For 21k

How Does Zillow Make Money Zillow Business Model In A Nutshell Fourweekmba